This offer is valid until March 2024

Mortgages

At Linkage Financial Solutions Whole of Mortgages Advisers based In Beverley in Hull , we specialize in providing whole of market mortgage solutions. Whether you are a first-time buyer, looking to remortgage, or interested in buy-to-let options, our expert team is here to assist you every step of the way.

With access to a wide range of lenders and mortgage products, we ensure that you receive unbiased advice tailored to your specific needs and financial circumstances.

Our goal is to help you find the most suitable mortgage deal that fits your budget and long-term goals.

Our dedicated mortgage advisors understand the complexities of the mortgage market and stay up-to-date with the latest industry trends. We will guide you through the entire mortgage process, from initial consultation to completion, ensuring a smooth and stress-free experience.

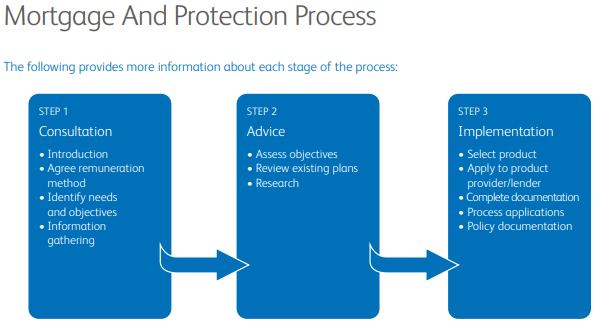

Consultation

Your Mortgage and Protection adviser will first introduce themselves and provide information about Linkage Financial solutions, how we would like to work with you, the services we can provide and the costs of those services.

We will talk to you about your mortgage and protection needs and objectives.

We will need to understand your mortgage and protection priorities and timelines for achieving them.

We cannot guarantee that we can meet all your objectives and goals but we can work with you to help you work towards them.

Throughout the fact finding process we gather personal and financial information from you so we can work out our recommendations and advice.

A key part of the Mortgage and Protection Process is deciding what services you would like and to agree how you would like to pay for them.

Please ensure you are clear with us on the services you want and how you will pay for them before we proceed with any work that may incur a charge for you.

You can agree with us that we should not exceed a specified budget limit without first consulting with you and receiving your written commitment to proceed further.

Advice

We will only provide advice on mortgages and protection policies to ensure that we can find the most appropriate solution for your needs at this time.

After working through the Consultation stage, we will then spend some time gathering further information about your current mortgage and protection plans, policies and any financial commitments.

Taking all these into account and based on your objectives and priorities, we will then be able to provide you with tailored recommendations.

We will always provide advice and ensure that suitable recommendations are made for your specific needs. Some mortgage products are only available directly from the lender, we will not consider these direct products as part of our research process.

When we recommend a mortgage to you we will always provide you with a mortgage illustration prior to completing the lender’s application form.

This sets out the basis of the mortgage and any fees associated with it.

You can also request from us at any time a mortgage illustration for any mortgage that we are able to offer.

Implementation

The Implementation stage will put in place the recommendations agreed with you on the tailored area or areas of advice identified to meet your mortgage and protection needs and objectives.

We will assist you in the completion of the relevant application(s) and any additional information required for submission to the product provider or lender.

It is vitally important you check all the information you have provided is correct before you sign any documents.

We will then monitor the processing of your application(s) through to policy issue and ensure you finally receive the related policy documentation.

We will also issue you with a suitability report that will confirm your objectives and our advice and recommendations to you in achieving these objectives.

Fees

We don't hide our fees in our web page and we guarantee that we are not beaten in price based on the quality of our research, solution and service.

To meet this Consumer Duty price and value outcome, we need to demonstrate the prices we charge represent value for money, and that our clients are getting fair value for the products we recommend and the services we offer.

Consultation - At our expense, we don't charge for a chat, coffee or tea!!

Implementation

- Residential & Buy to let - Our maximum fee is £495.00. This fee may be reduced dependent on the complexity of the case.

- Our fees are paid on application, which will be fully re-funded if you don't exchange contracts through no fault of your own.

For Equity Release, Commercial Lending or Second Charge the fees are dependent on the complexity of the case.

Existing Mortgage customers won't be charged for product switch's.

We reserve the right to charge more or less based on the complexity of the tailored solution and service required.

We agree our fees in advance and we will never charge you without your agreement.

We also will review your Protection and Building & Contents insurance free of charge

Mortgages – Please note your home may be repossessed if you do not keep up repayments on your mortgage.

Equity Release – This form of lending is most suitable for those over 65, however, it’s possible to do this if you are over 55. It is important to understand that these are lifetime mortgages and to understand their features and risks, you will need to have a personalised illustration.

Types of mortgage brokers

A whole-of-market broker will be able to assess every available mortgage so they can recommend the very cheapest or most suitable deal for you. This could potentially save you a lot of money.

Tied mortgage brokers: These brokers can offer you a mortgage only from a specific single lender.

Multi-tied mortgage brokers: These brokers can offer you a mortgage from a select panel of mortgage providers.

Whole-of-market brokers: These brokers have access to all of the mortgage products available on the market. (Like us)

Independent Financial Advice & Mortgage Brokers

2nd floor, 37a North Bar Within, Beverley, HU17 8DB

Call us Now on 01482 350375 or Sheffield 0114 3087676

Privacy Policy Best Execution Policy Client Classification Conflicts of Interest Policy Your guide to making a complaint Personal Client Agreement

Linkage Financial Solutions Ltd is an appointed representative of 2plan wealth management Ltd which is authorised and regulated by the Financial Conduct Authority. Linkage Financial Solutions Ltd is entered on the FCA register (www.FCA.org.uk) under no. 998729. Registered office: 2nd Floor, 37a North Bar Within, Beverley HU17 8DB. Registered in England and Wales Number: 14757948.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.